irvine property tax rate

This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. Rents at more than 1000 units at two apartment buildings in Irvine are expected to be marked down and turned into the citys first housing priced for people making middle-of-the-road incomes.

Orange County Ca Property Tax Calculator Smartasset

3420 12th Street Riverside CA 92501-3842.

. The California sales tax rate is currently. Failure to pay these taxes before Feb. The average effective property tax rate in California is 073.

And your ad valorem annual property taxes for the property would be one percent or the amount of 5000. So when you buy a home the assessed value is equal to the purchase price. 074 of home value.

California property taxes are based on the purchase price of the property. Irvine forgoes property taxes to convert 1000-plus units to middle-income housing. 7097 each year in property taxes.

Did South Dakota v. Frequently Asked Questions on Taxes. The minimum combined 2022 sales tax rate for Irvine California is.

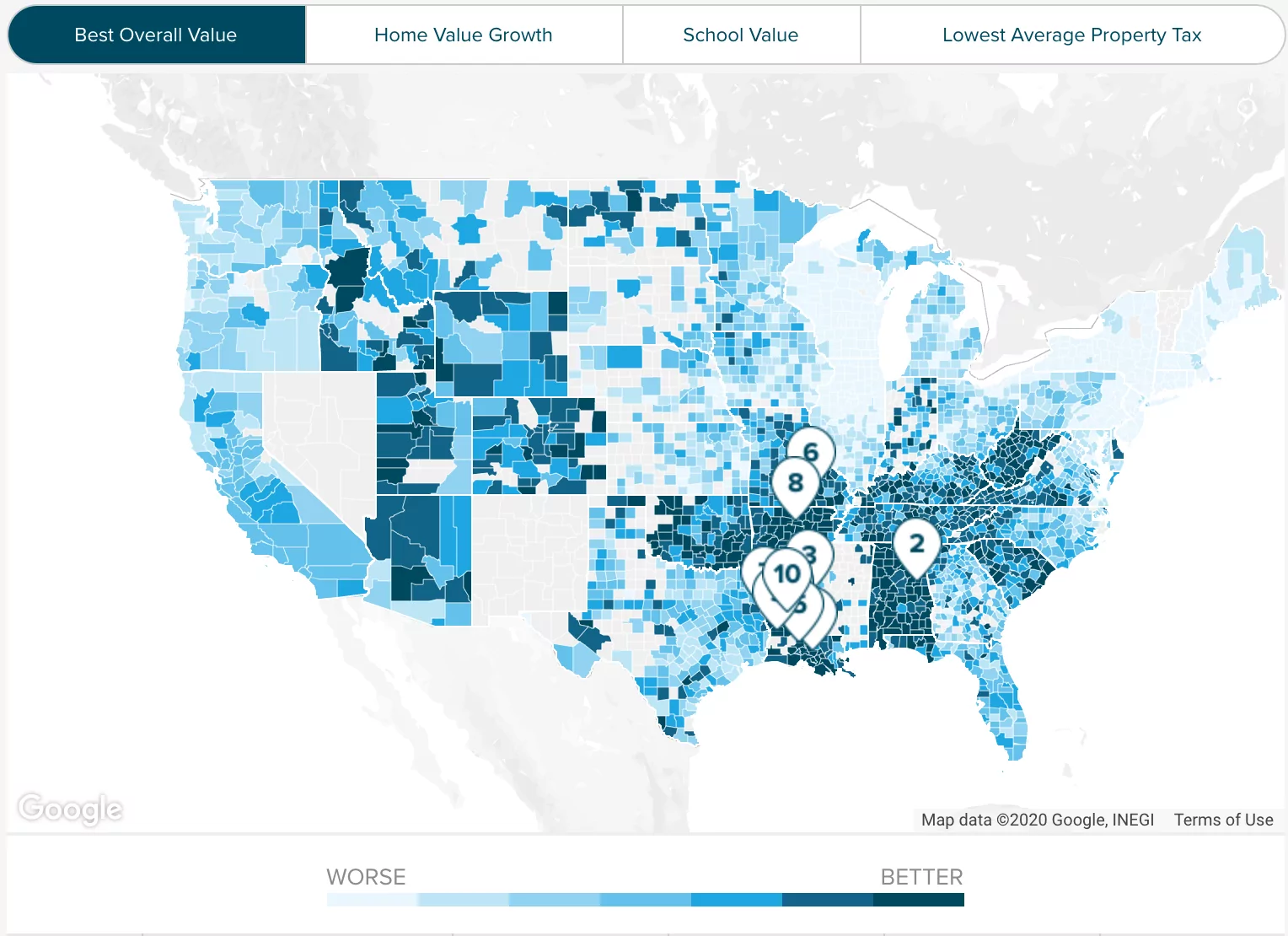

Should you be presently a resident just considering taking up residence in Irvine or interested in investing in its real estate learn how local property taxes work. Each area is assigned a number herein. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year.

Total rate applicable to property within a specified area. YEARS WITH 949 729-1040. The County sales tax rate is.

411 West 4th Street Santa Ana CA 92701-4500. 26-000 irvine city 255 27-000 mission viejo city 275 28-000 dana point city 280 29-000 laguna niguel city 286. Rents at more than 1000 units at two apartment buildings in Irvine are expected to be marked down and turned into the citys first housing.

3 Corporate Plaza Dr Suite 260 Newport Beach CA 92660. The Irvine sales tax rate is. 1 results in a penalty of 6 percent plus 1 percent per month until.

Be sure to check each individual home you are considering buying to get the exact property tax rate. For Unsecured Property Tax Bills SEARCH BY. Website Directions More Info.

Understand how Irvine levies its real property taxes with this comprehensive guide. The city of Irvine has received 93 million from special taxes on the Great Park in the last five years and is set to receive an additional. 411 West 4th Street Santa Ana CA 92701-4500.

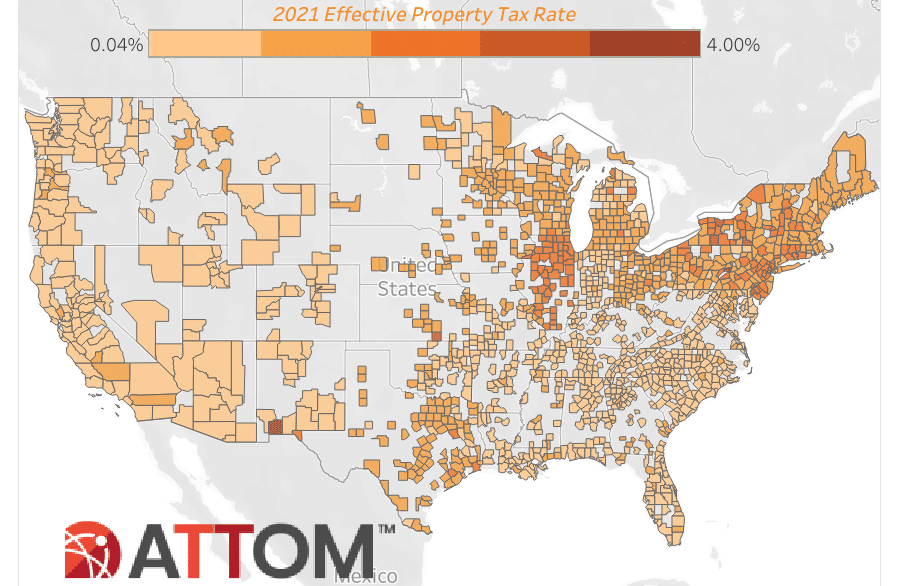

The Irving City Council adopts a tax rate for property taxes each September when the budget is approved. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The property tax rate is higher than the average property tax rate in California which is 073.

Wayfair Inc affect California. Other Taxes Particular to City - Utility User Tax UUT on intrastate telephone use all electricity and gas on commercial - 15. Parcel Number APN or.

Use the Property Tax Allocation Guide. Property taxes are collected by the Dallas County Tax Office in one installment. Santa Ana CA 92701.

School Bond information is located on your property tax bill. Please CLICK on the FIND button after keying in information in the SEARCH Box for Property Information. Name A - Z Ad Gregor and Co AAC.

While paying property taxes isnt particularly fun the revenue generated from Orange County property taxes is needed to provide funding for schools public libraries and other local projects and initiatives. Sometimes called workforce housing the lower-rate units are. County of orange tax rate book.

To calculate your specific annual property tax simply multiply the value of. 411 West 4th Street Suite 2030 Santa Ana CA 92701-4500. Tax amount varies by county.

For Secured or Supplemental Property Tax Bills SEARCH BY. PayReviewPrint Property Tax Bill Related Information. Irvine Hotel Improvement District Assessment Tax - 2.

Link is external PDF Format Change of Address for Tax Bill. Property Tax Rate in Irvine CA. This is the total of state county and city sales tax rates.

Property Tax Rates Listings. Tax Reporting Service Accountants-Certified Public Tax Return Preparation. Whether you are already a resident or just considering moving to Irvine to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

15 and are due Jan. Claim for Refund of Taxes Paid. How Property Taxes in California Work.

This means that a home valued at 250000 will pay about 1788 in property taxes in a given year. This compares well to the national average which currently sits at 107. Santa Ana CA 92701.

If you are buying a home at Irvine or anywhere in Orange County for 500k the assessed value will most likely after sale will be 500k. California has the 8 th highest property tax rates in America and Orange County isnt even the most expensive county. Real estate in Orange County is taxed at a rate of 072.

Bills are mailed about Oct. Cost Of Property Taxes In Irvine CA. Average Property Tax Rate in Irvine.

Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499. School District Bond Rate. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

Please note that this is the base tax rate without special assessments or Mello Roos which can make the rate much higher. Learn all about Irvine real estate tax. 140 South Motor Avenue Azusa CA 91702-3225.

Luckily some of that cost can be avoided in Irvine.

Appealing Your Property Taxes Consider Expert Help Tax Attorney Property Tax Tax

Why Rent When You Can Own Check Out Our Five Main Reasons Why You Should Buy A Home Today Call Us Toll Free At 888 544 Home Buying Real Estate Marketing Rent

Exterior Beverly At Eastwood Village In Irvine Ca Brookfield Residential Brookfield Residential New Homes Residences

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Cara Menghitung Penghasilan Tidak Kena Pajak Ptkp Ptkp Ini Merupakan Salah Satu Komponen Terpenting Dalam Peng Tax Services Accounting Services Filing Taxes

Understanding California S Property Taxes

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Tax Value Of Orange County Real Estate Surges 6 3 Orange County Register

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Orange County Rush To Pay Property Taxes Boosts Collections 9 Fold Orange County Register

States With The Highest And Lowest Property Taxes Property Tax States Tax

Julio Gonzalez Renowned Tax Expert Speaks Out On Tax History Budget Planning Budgeting Global Real Estate

Pin On Platinum Mortgage Company

Orange County Ca Property Tax Calculator Smartasset

Why Property Taxes Are Significantly Higher In The Great Park Neighborhoods Cfd 2013 3 And It Doesn T Sunset Irvine Watchdog

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Orange County Property Tax Oc Tax Collector Tax Specialists

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax